Good wealth management needs excellent accounting

You can’t manage what you can’t count.

Decision-makers in family offices require real-time, efficient, and detailed information for risk assessment and maximizing investment returns.

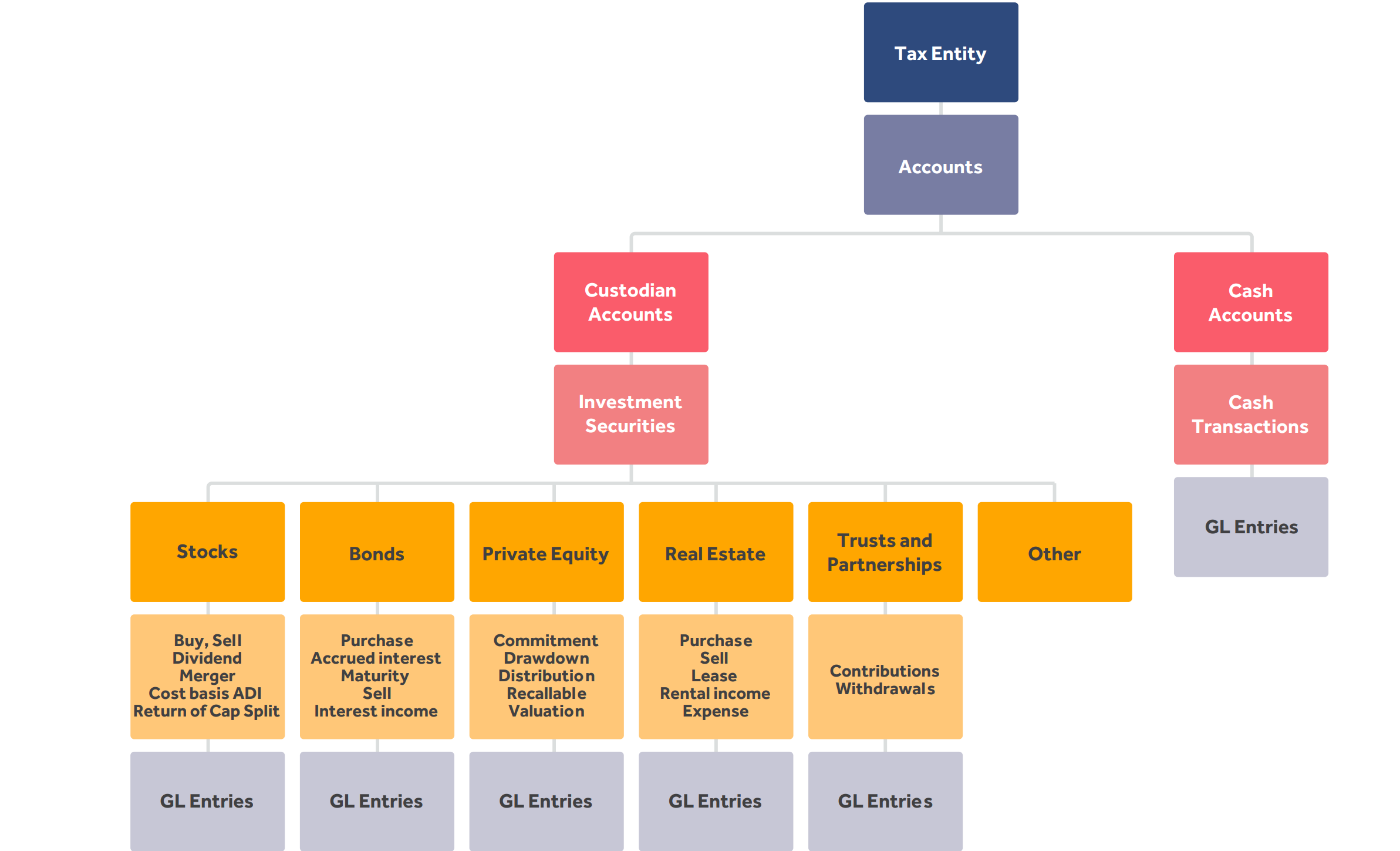

Robust modern accounting systems are essential for tracking complex family investments, which can involve various structures like trusts and partnerships, given the strong connection between investments and accounting.

Here’s how:

An ideal family office investment and accounting system is one which integrates complex wealth into a single source of truth:

- Consolidates diverse asset data: financial and non-financial

- Identifies direct or indirect ownership entities.

- Aggregates ownership and income flow.

- Enables retroactive reporting to match accounting needs.

And supports various other statutory needs of a world-class record-keeping platform:

- Generates analytical and regulatory reports

- Uses automated processing to reduce errors

- Builds in best practices to maintain uniformity in processes

- Includes robust audit capabilities to support reviews and track data changes

Asset Vantage empowers family offices with a one-stop solution that helps them run their family offices like a business, by providing a full and correct picture of the family’s wealth, encompassing all its assets, liabilities, and expenses in a single frame.

For more information on accounting and best practices, Download the FO4 handbook