Did you ever think you would see the day when “do-good” investing could actually generate wealth?

After years of trailing the S&P 500 and international benchmarks, ESG index funds began to outperform them in 2020.

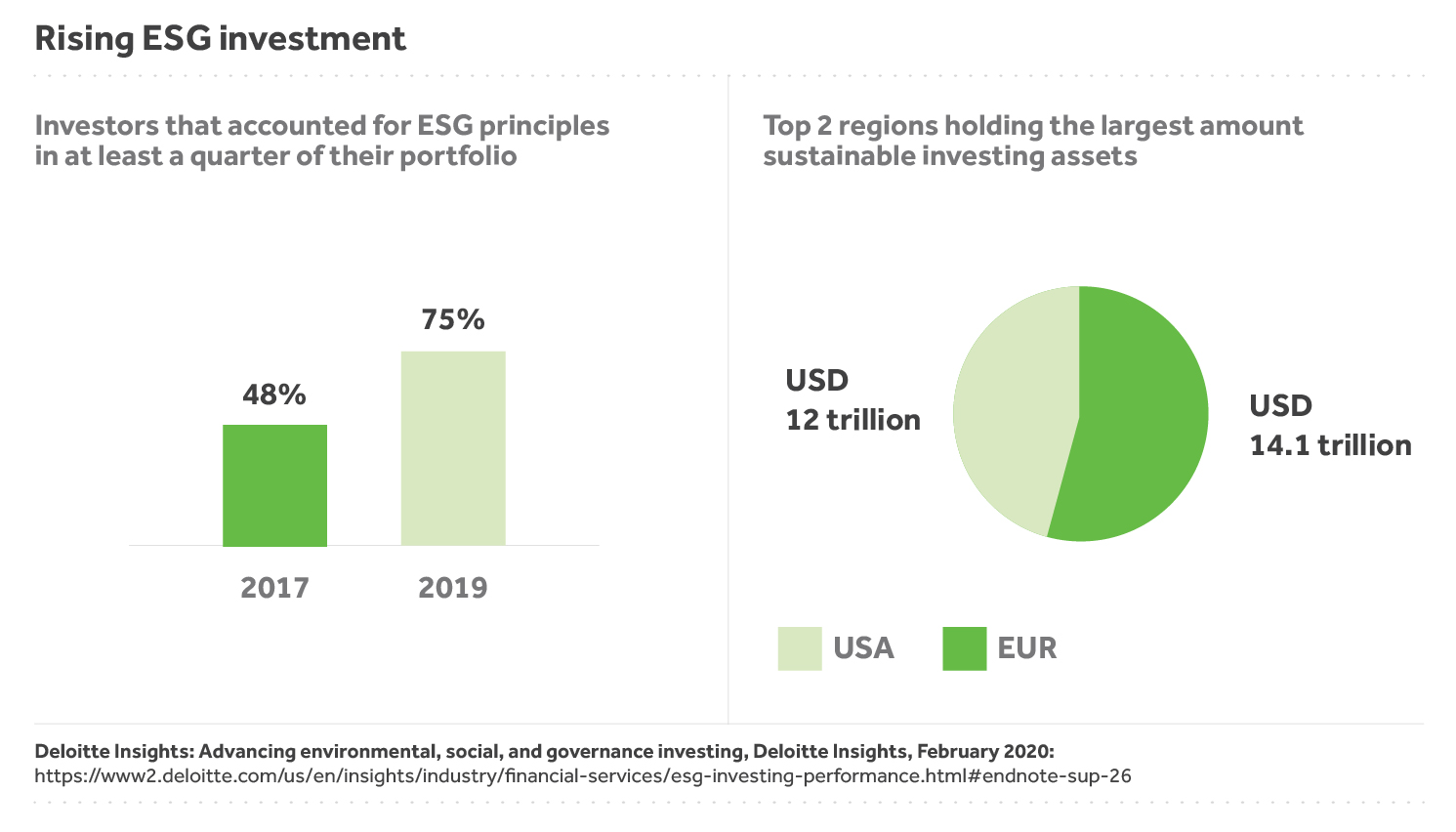

Raising awareness, rising investments

Celebrities and activists like Leonardo DiCaprio and Greta Thunberg are confronting global leaders. Sustainability and climate change are triggering mainstream conversations and lifestyle changes. The concern for the planet and humanity has translated into financial investment decision-making.

Investors are paying attention to the environmental, social and governance (ESG) policies of a companies. The HNW demographic

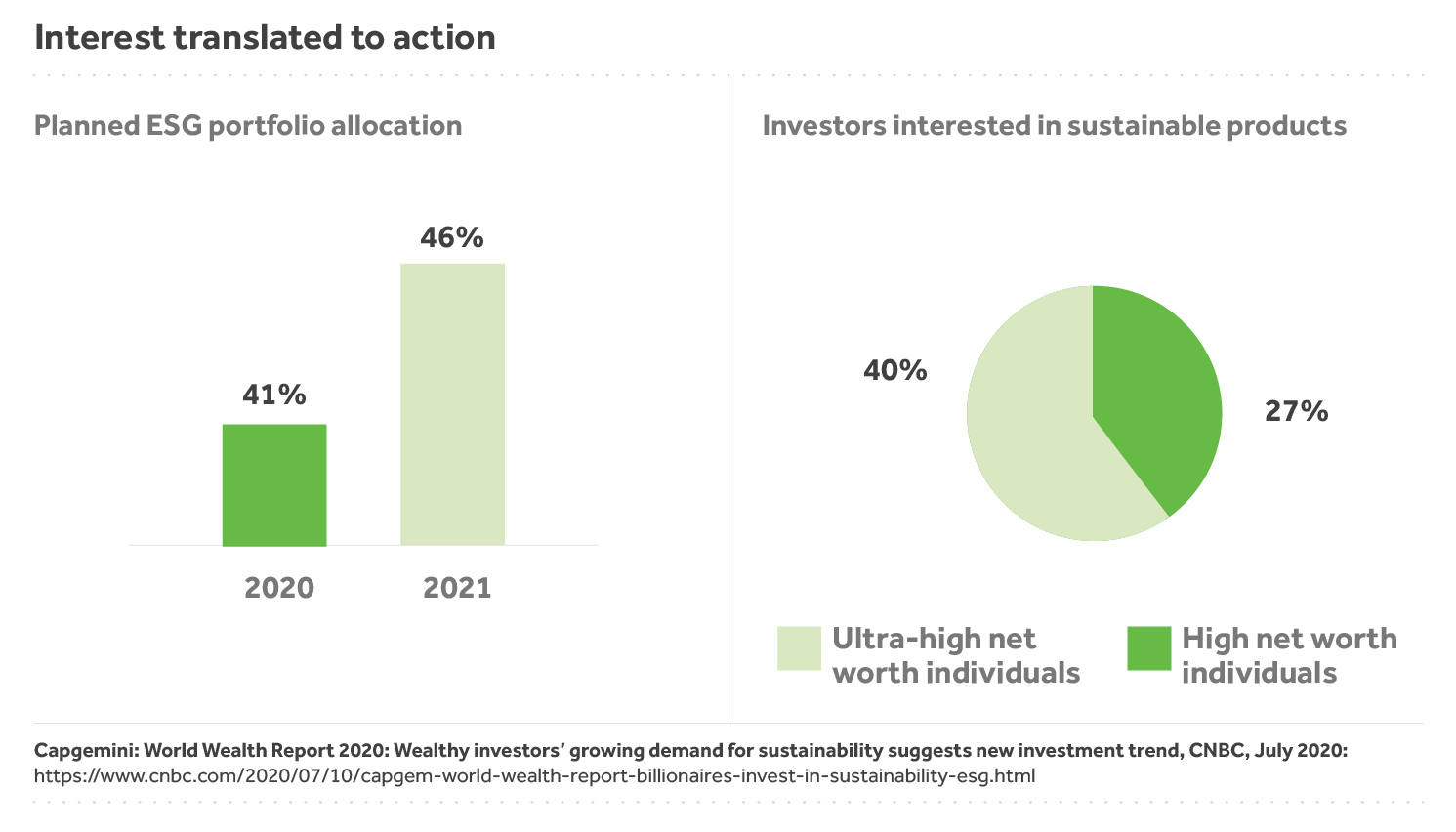

The HNW demographic

Driven by personal beliefs, individuals, especially millennials, are more inclined to make ESG-based investments.

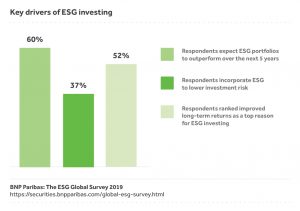

Ethical is the new smart

Though ESG investing commenced in the 1960s, the prevalent belief was that such investments were for romantic idealists and yielded lower returns.

The Deepwater Horizon oil spill (2010) damaged stock prices along with the environment. The scandal continues to hang over the brand value of the company, with the oil spill colloquially referred to as the ‘BP oil spill’. Expectations from family offices

Expectations from family offices

What does the ‘organic’ in organic food mean? That parameter differs in every country. ESG investments are the same way. Part of the problem is that you can’t identify those quickly and it’s difficult to get to the root of what is driving a company. – Lindsay Cook, knowledge partner at AIP Drexel.

ESG criteria are subjective and measuring them is a challenge. Institutions and governments are working to form standards for incorporating ESG guidelines into investment processes. However, even before they come into effect, financial advisors will still need to advise clients and integrate ESG factors into their investment and reporting.

Families are increasingly asking for where they stand on ESG investments as compared with the trend and to make this an important pillar of their Investment Policy Statement.

Do you as a trusted advisor have the reporting and investment screening required to deliver?

Learn how families track investment groups with AV’s powerful investment-tagging feature.