“There is really only one way to address cash flow crunches, and it’s planning so you can prevent them in advance.” — Elaine Pofeldt, author of The Million-Dollar, One Person Business

Every goal needs to be backed by a sturdy yet flexible plan. Families may have a firm grip over their investments’ notional returns, but lose sight of the real item at the end of the day – cash.

“We were always focused on our profit and loss statement. But cash flow was not a regularly discussed topic. It was as if we were driving along, watching only the speedometer, when in fact we were running out of gas.” — Michael Dell, founder and CEO of Dell Technologies

When building a plan to achieve your wealth aspirations, supplement it with cash flow forecasts that are as accurate as possible. The most significant yet often omitted factors are:

- Expense budgeting

- Tax planning

Both these aspects have consequential effects on asset allocation, too.

Expense Budgeting

The wealthiest families in the world were quick to realize this.

A budget tells money where to go, so you do not have to wonder where it went. Use technology to track and categorize expenses against a pre-set budget. Keep an eye on the long-term horizon and ask questions like:

- Are the fixed sources of income sufficient to sustain current living expenses?

- Are living expenses expected to increase?

- Is there a regular review of expenses as a ratio to total assets under management?

- Is cash available to invest in desired assets in the coming years?

- Is there a major expense coming up, such as the purchase of a business or property?

- Is there enough money to contribute to charity?

Tax Planning

Taxation is a substantial part of investment-related expenses. It affects both return on investments and cash flows. Badly planned, it can cause liabilities in the form of penalties and long-drawn expensive litigation with the authorities.

Before undertaking any investment, consult a tax accountant. S/he will shed light on:

- Method and periodicity of tax on income from proposed investment

- Possibility of tax expense deduction

- Future capital gain implications upon selling the investment

- Tax reporting and compliance associated with proposed investment

- A better investment alternative from a tax perspective, if any

- Upcoming taxation law changes

Where families make charitable donations by transferring stock, they need to consider the impact on their cash inflows and the potential for tax benefits.

A thorough discussion on these lines will enable you to plan your taxes. Carry out periodic taxation reviews to ensure you earn the best possible overall returns within the purview of applicable laws.

Update your compliance calendars to keep a track of legal duties surrounding your investments. This averts undue interest and penalty expenditure.

Expense budgeting and tax planning highlights the importance of building a dynamic Chart of Accounts, which enables accurate tracking of expenses (personal or otherwise), compliance with taxation laws and forecasting of cash flows.

Cash Flow Forecasting

A family may have assets worth USD 10M. But reporting USD 10Mand actually having that amount in hand for use are two different things. Half of those assets may be earmarked for investment (say, a property installment or a private equity commitment), or for charity. This, in effect, renders those assets illiquid.

If the family is unknowingly reliant on funds designated for such commitments, it may end up liquidating other assets. It may have to do so at sub-optimal rates, and bear unfavorable tax consequences.

Such unpreparedness and lack of planning usually leads to monetary loss.

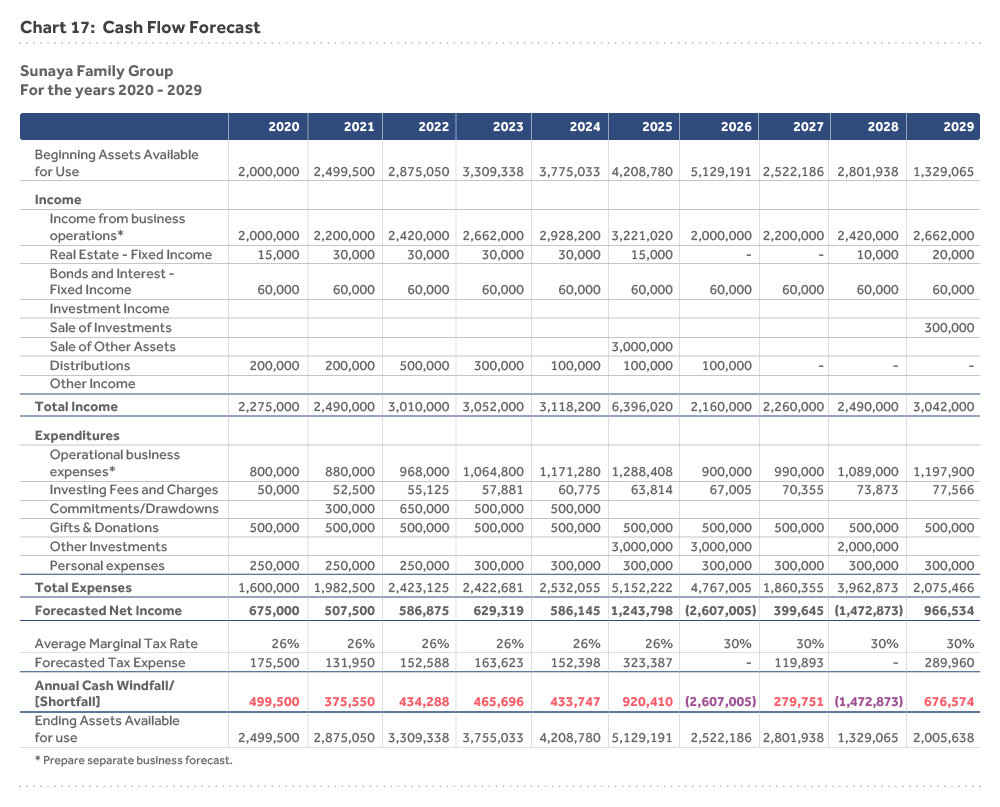

The accounting and reporting system should be able to earmark assets and determine their liquidity status. It should help in generating cash flow forecasts, an example of which is given below:

“In the long run, it’s not just how much money you make that will determine your future prosperity. It’s how much of that money you put to work by saving it and investing it.” – Peter Lynch, legendary investor and fund manager

Budgeting and forecasting gives control over wealth and plugs expense leakages. This, in turn, leads to additional savings.

The corollary to saving is investing. Money generates returns and mobilizes the power of compounding only upon investment.

The sole creature in the world that never sleeps is interest. Compounding lets you earn not only on the money saved, but also on the interest earned by that money. Thus, money can work round the clock, multiplying or depleting itself.

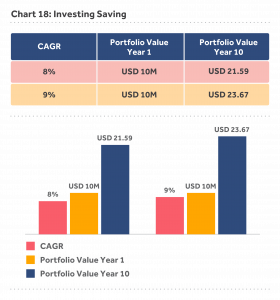

A small increase in returns or reduction in costs will have a dramatic increase in the long-term value of your portfolio. For example, a USD 10M portfolio’s returns increasing by just 1% over 10 years produces an additional return of USD 2M:

Grow your wealth faster than inflation undermines it. Invest in interest or dividend-generating assets. Or earn capital gains by purchasing and selling assets that appreciate in value.

Generate as much passive income as possible. A passive income is one which requires little ongoing participation from you. It exemplifies self-sustaining wealth and financial freedom.

Key Takeaways

- Lifestyle and personal expenses require the same orderliness and discipline that is applied to business finances

- A budget tells money where to go, so you do not have to wonder where it went

- Tax planning affects investment returns and cash flows

- Reporting USD 10M and actually having that amount in hand for use are two different things

- Savings must be invested to harness the power of compounding.